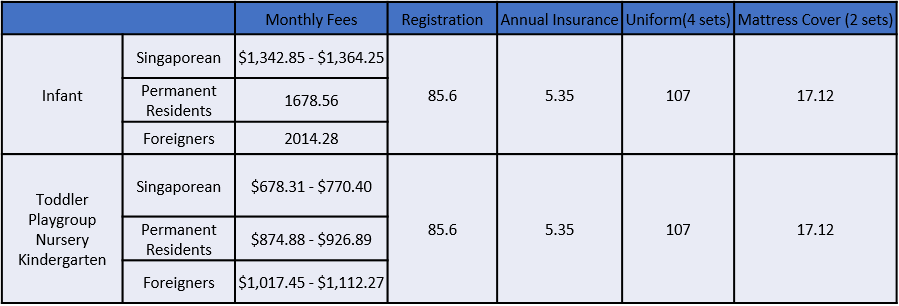

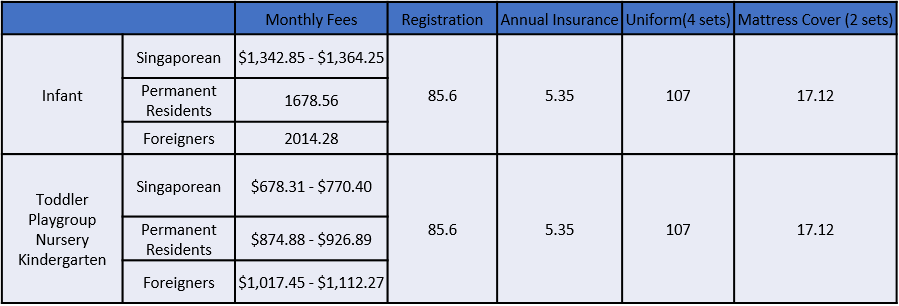

The following is a table of the fee for early childhood education/programme (as of 1 Jan 2017):

Source: Click here

Anointed | Charitable | Transform-lives | Serving

The following is a table of the fee for early childhood education/programme (as of 1 Jan 2017):

Source: Click here

The following is a table of the estimated costs of education and the amount you need to set aside.

** 2016 Annual Tuition Fees

Source: Click here

MediShield Life is a basic health insurance plan that protects all Singapore Citizens and Permanent Residents for life. The coverage is sized for subsidised treatment in public hospitals, which helps you to pay for large hospital bills and selected costly outpatient treatments, such as dialysis and chemotherapy for cancer. Click on the image to learn more about the benefits:

Source: Click here

A money-wise talk on capitalizing on your parenting & baby bonus schemes to live a stress-free parenthood. If you are keen to register for this event, please register here!

By now you might have already read alot of articles and posts by a number of sources that tells you in order to reach financial freedom, you need to build sources of passive income. True enough, everyone is aware of the term passive income but what is the very first step to build this additional set of income, that allows you to lead the lifestyle you want while shaking your leg and let the money “work” for you?

There is no hard and fast rules and no tricks to avoid this very first step and that is to save up. I guess I do not need to go into details on how to save up but the guideline I suggest for you to follow is to save up at least 10% to 20% of your income. At this point, you must be thinking “That SIMPLE?! This is common sense!”. Truth be told, simple advice is most often the hardest to follow through. If you have already have a decent amount of savings let’s continue to look at the comparison of the effort you need to put in for active income and passive income.

| Active Income (Material Participation of work/service) | Passive Income (NO Material Participation) |

| Employment income | Rental Income |

| Tips | Affiliate links |

| Salaries | Interest income |

| Commissions from work | Commissions from Referrals |

| Active Business Income | Buying shares and collecting dividends |

| Conducting a course | Business Franchise |

Now let’s add in some actions into the comparison that I listed out below and compare which is easier to achieve in a long-run and which activities will allow you more control over the amount of money you want to make.

| Active Income (Material Participation of work/service) | Passive Income (NO Material Participation) |

| Negotiate for a higher Employment income | Buy a House that is cheaper so higher Rental Yield |

| Serve customers well to get more tips | Setup a website with multiple Affiliate links |

| Work overtime and have more Salary | Invest your money for higher returns |

| Network more for more commissions | Have more referrals |

| Employ staff to delegate work for Active Business | Buying good and deep value shares |

| Conducting more courses | Set up more Business Franchises |

Most people want to achieve passive income but they do not know how to get there, would you like to come meet us and find out more from us?

If you are interested to know more, you can:

Email: admin@actsadvisorygroup.com

Whatsapp: +65 8430 4902

Phone: +65 9475 8860